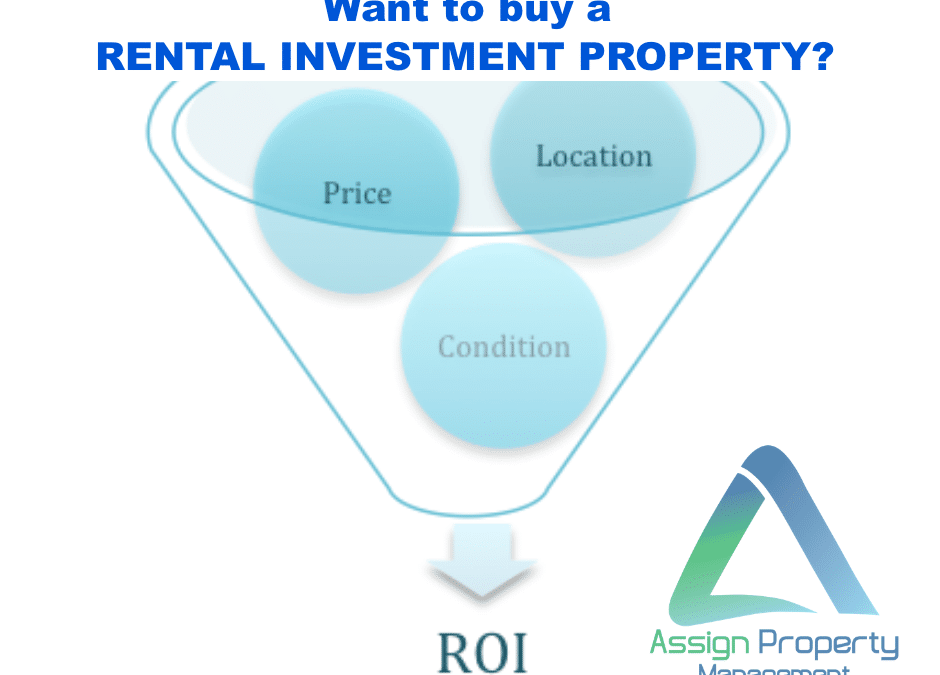

If you’re considering becoming an investor/landlord, let’s first look at the basics. The three factors, or “tri-fecta” of real estate investing come down to: Location, Condition and Price. If you look at these carefully before making a buying decision, you should be well-positioned for a profitable investment.

First, LOCATION, LOCATION, LOCATION

This is a timeless principle, and time has proven that Location matters. In so many ways the location of your property will determine its success. Consider, is it on a busy road? What’s the school district rating? How about crime? How are the amenities or how far is shopping and entertainment? And the big question to ask yourself is…Would I live here or would I be ok with my family living in this area?

Secondly, PRICE

You may be tempted to look for the “cheapest” property price, but this can come with some pitfalls. Cheap doesn’t mean best, and the old saying about “You get what you pay for” is true. Some key thoughts are to: 1. Run the numbers and have reasonable expectations concerning value vs. price. It is important to do your due diligence and ensure you are paying what the home is worth – Know the comparables, and 2. Hire an inspector to learn the condition (we’ll address that further in the next section) so you can plan ahead and budget for repairs, maintenance and improvements, and 3. Know the market…this one is ever-changing and no one can predict the future, but getting educated about both the general and micro-market of the property is important, and 4. Price includes understanding that you have fees for taxes, association dues and insurance, so know your numbers.

Third, CONDITION

It’s important to carefully examine the property and know what you’re getting into. If you have experience in the areas of remodel and construction, then you’re a step ahead. But if city permits, codes, remodel and inspections are foreign to you, then starting with a property inspector is the best place to begin. At the very least for a small amount of money, you’ll know what you’re walking into, such as age/condition of the roof, foundation, appliances, plumbing, electrical, HVAC and more. You can also learn about any past repairs and potential warranties still in place?

Closing Thoughts

Many people jump into real estate investing without carefully working through the actual cost of an investment property. But if you take the time to answer key questions about Location, Price and Condition, then you’ll find yourself in a much better position to have a positive return-on-your investment. At Assign Property Management, we understand the importance of all three parts of this “tri-fecta” relationship. Feel confident that by contacting us to help guide you through the process of identifying, purchasing and maintaining your long-term investment, you’ll be in great hands to reach for the long-term goal of your wealth creation through real estate.

Article written by Deanna Parnell and John Davis